November 2024 Client Newsletter

Stephen Merritt, CPA, PC | Certified Public Accountants | (757) 420-5778

233 Business Park Drive, Suite 104, Virginia Beach, VA 23462

Your monthly news & updates

What’s Inside

What’s Inside

November, 2024

- Watch Out for These Tax Myths

- 2025 Social Security Changes

- The Good – and Not So Good – of AI

- Avoid Sneaky Fees Draining Your Bank Account

Watch Out for These Tax Myths

Many myths about the IRS and the tax code have been amplified online in recent years. Here are several myths that if you believe them, could leave you with an expensive tax surprise.

Myth #1: Retirement money is always tax free.

You have retired and withdraw from a 401(k) fully expecting that you won’t owe income taxes. Unfortunately, money withdrawn at any age from a 401(k) – or your traditional IRA – incurs income taxes at your current tax rate.

Lesson Learned: Understand how money in each of your retirement accounts is taxed when withdrawn. Some will have income taxes, some could incur early withdrawal penalties, while some incur no tax at all!

Myth #2: The government won’t find out about a big gambling win.

Gambling winnings are considered taxable income to the feds and most states. The IRS generally wants about a quarter of your winnings from sweepstakes, casinos, bingo, keno, online sports betting, and the like. Casinos and other betting entities also inform the IRS of your winnings over certain thresholds. So it is always best to keep track of your winnings.

Lesson Learned: Gambling winnings fall under tax rules just like other forms of income. Deducting gambling losses is possible, but it has limits that are subject to strict rules. For example, you must itemize deductions on your tax return if you don’t declare yourself a self-employed professional gambler.

Myth #3: Government benefits like unemployment and Social Security aren’t taxable.

Unfortunately, unemployment and Social Security benefits are usually taxable. Unemployment benefits are taxed at your normal tax rate as income at the federal level and in some states. Social Security is taxed, but in a much more confusing way. Supplemental Security Income payments, on the other hand, are not taxable.

Lesson Learned: Plan ahead to mitigate the tax shock. You can have taxes withheld from your unemployment benefits so you don’t have to pay a lump sum when you file your return. With Social Security benefits, understand when and how they can be taxed, since up to 80% of these benefits could be subject to income tax by the federal government.

Myth #4: I work from home and can write off my office expenses.

You can only deduct home office expenses if you operate a business out of your home. If you’re an employee, you’re out of luck. If you do run a business exclusively out of your home, there are still hurdles to clear before you qualify to use the home office deduction.

Lesson Learned: Tax rules can be complicated, even for something that seems as simple as a home office deduction.

If there’s one common theme here, it’s that tax laws can be complex even when they seem simple on the surface. When in doubt ask for help.

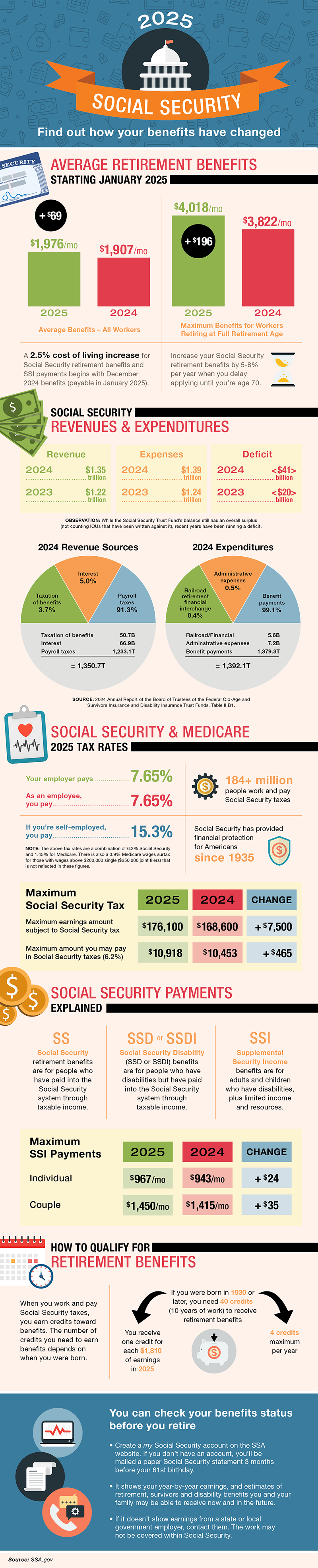

2025 Social Security Changes

The Good – and Not So Good – of AI

At its heart, technology exists to solve problems and enrich our lives, but its journey is rarely straightforward. The rapid integration of Artificial Intelligence (AI) into everyday tools—like search engines, smart speakers, and virtual assistants—perfectly illustrates the challenges that come with disruptive innovation. Here’s a quick look at how AI is improving our lives, but where we also need to take a step back to be more cautious.

The upside of AI: Empowering efficiency

- Has instant access. Unlike humans who are prone to distractions, emotions, or getting tired, AI can operate without any such issues. Since it’s powered by algorithms, human-related points of failure such as stress-induced errors are virtually eliminated.

- Accelerates data processing. AI can quickly sift through vast amounts of data, pinpointing inconsistencies, outliers, and trends in seconds. Tasks that would take a human hours, if not days, are reduced to mere moments, allowing us to focus on higher-level analysis and decision-making.

- Always available for automated tasks. AI automates repetitive tasks, cutting down on administrative busy work and freeing up our time for more complicated tasks. It’s also always available – wherever you have an internet connection.

The downside of AI: Tread carefully

- Plagiarism is likely to occur. AI doesn’t care if the information it creates is owned by someone else. This plagiarism can happen when creating music, text, voiceovers, and other forms of creative expression.

- AI blends truth AND fiction. While AI excels at many things, fact-checking and proper citations aren’t among them. Like Wikipedia, AI can be a useful starting point but shouldn’t be trusted as a sole authority. AI’s outputs may include inaccuracies, making it unreliable for in-depth research or professional use.

- Lacks true creativity. AI may do a great job to organize and repackage information, but it still falls short when it comes to true innovation. Creativity, by nature, is abstract and requires out-of-the-box thinking that AI has yet to master. Its outputs are rooted in existing data, meaning that groundbreaking ideas remain out of reach.

- Reduces critical thinking skills. While technology often makes life easier, it can also make us mentally lazier. Think about how difficult navigating a new city would be without GPS! Similarly, if we become overly reliant on AI for decision-making, our critical thinking skills may weaken over time, leading to a decline in actual human intelligence.

- Can lead to serious legal and tax issues. Relying on AI for legal, tax, or other professional advice can leave you in hot water. While AI may be appropriate for initial research on a particular issue, remember that AI itself isn’t a registered attorney or tax preparer. You should still rely on the knowledge and experience of professionals when advice is needed.

The verdict: Use AI as a tool, not a crutch

AI has the potential to be a powerful tool to complement our own human ideas and capabilities. It’s far from ready, though, to be the sole source of truth. Like any emerging technology, it should be approached with both curiosity and caution.

Avoid Sneaky Fees Draining Your Bank Account

Inflation isn’t the only reason why your wallet or purse feels lighter these days. Sneaky fees are finding their way into things we buy every day. Here are some common fees you may encounter and what you can do to avoid them altogether.

Common areas with sneaky fees

- Checking account fees. Banks love to nickel and dime you with fees if you don’t maintain a minimum balance or have sufficient direct deposits. It creates a gotcha moment at the end of the month.

- Dealership fees. Buying a vehicle? Dealers are known for tacking on hidden charges like vehicle prep fees. These can easily inflate the sticker price if you’re not paying attention.

- Ticket broker fees. Concert or sports event tickets seem expensive enough, but when ticket brokers add an additional service fee, it’s almost enough to make you stay home. These fees can be up to several hundred dollars!

- Vacation rental fees. Dreaming of a vacation getaway? Convenience fees, cleaning fees, and other add-ons can push the cost of your vacation rental sky-high, turning your relaxing trip into a financial drain.

Smart moves to outsmart sneaky fees

Here’s how you can fight back.

- Understand the fees before you start. For example, when you are considering a rental, get a breakdown of all the fees before you book. The same holds true for buying a car or a plane ticket. The vendors technique of hiding fees to make a service look cheaper does not need to work when you buy.

- Negotiate like a pro. Ask questions or challenge fees you don’t understand. Whether it’s a merchant, a car dealer, or a bank, there’s often room to negotiate. You might be surprised how often they’ll waive the fees just because you ask.

- Switch providers. Many companies charge for services that others offer for free. Tired of your bank’s account fees? Look for one with a truly free checking account—because yes, they do exist.

- Cut out the middleman. Avoid unnecessary fees by dealing directly with providers. For example, if you’re booking a vacation rental, skip platforms like Airbnb that charge a convenience fee and book directly through the owner when possible.

- Say no. Sometimes the best way to save is simply not to buy. If a purchase or service comes with fees that seem outrageous, you can always walk away. By saying no, you send a message to companies that you won’t tolerate being taken advantage of—and you’ll save money in the process.

By knowing how to spot and challenge these fees, you can stop the drain on your wallet and take back control of your finances. After all, it’s not just about cutting costs—it’s about standing up for yourself and your money.

As always, should you have any questions or concerns regarding your tax situation please feel free to call.

November Days

Here are some Days to Remember in November!

November 11th – Veterans Day

November 28th – Thanksgiving

November 29th – Black Friday

Reminder

Conduct year-end tax and financial planning

Office Hours

Closed on Thanksgiving:

from November 27th – 29th

After Tax Season Hours:

Monday – Thursday

8 AM to 5 PM