Provisions of the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010

This new act will impact the way employers calculate the social security withholding tax for their employees. In 2010, both the employee and employer tax rate for social security was 6.2%. Because both the employer and employee were taxed at the same rate, the employer “matched” the employee’s social security withholding amount. This will no longer be the case with the new regulations.

The new 2011 regulations have changed the employee’s social security tax rate to 4.2%. The employer tax rate remains 6.2%. There is no change in the Medicare tax rate, which is still 1.45%. If an employer has already run payroll in 2011 and has not yet implemented the changes, no immediate problems are created. The IRS urges employers to implement the rule as soon as possible. If the employer used the 6.2% social security rate to withhold social security from their employees, the employer should make an offsetting adjustment in a later pay period to correct the overwithholding of social security.

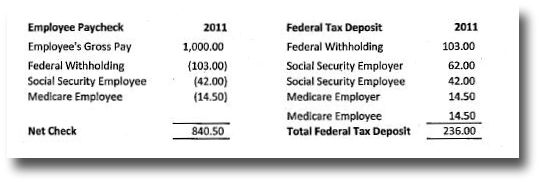

Below is a sample employee check and federal tax deposit showing the withholding taxes for payroll in 2011. This sample pay stub is for a single employee who earns $1,000 during a bi-weekly pay period.

Please contact our office if you have further questions or would like us to calculate your paychecks.